Payeezy Gateway Fundamentals Explained

Wiki Article

The Basic Principles Of Square Credit Card Processing

Table of ContentsThe Definitive Guide to Virtual TerminalClover Go Fundamentals ExplainedThe 10-Second Trick For EbppThe Single Strategy To Use For Fintwist SolutionsIndicators on Clover Go You Should KnowEverything about Payment HubThe Only Guide to Clover Go

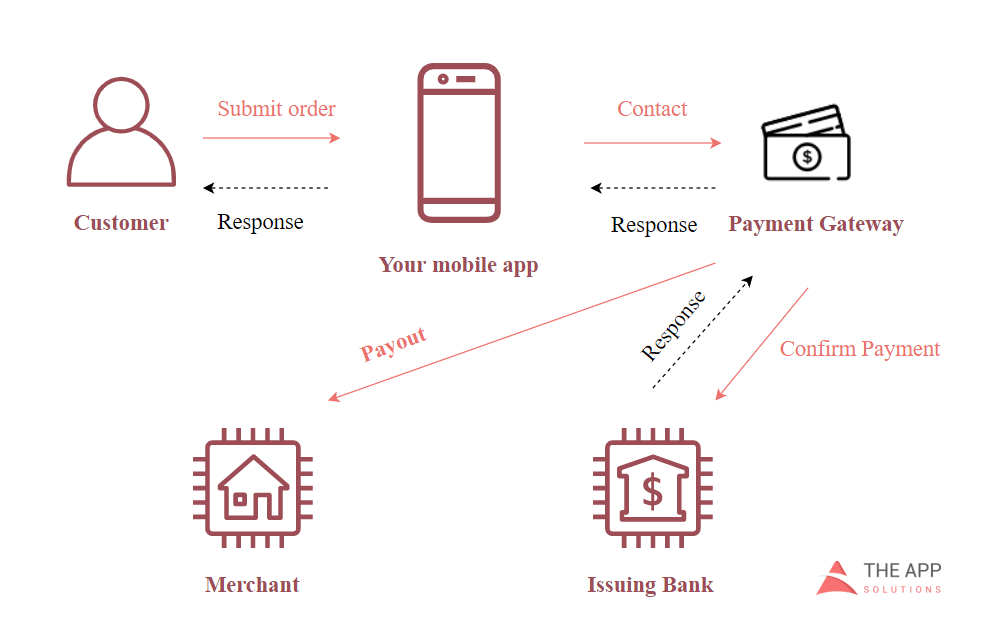

similar to reimbursement yet can be done if funds were not yet caught. Payment handling flow The infrastructure of online payment processing is a little much more complicated than you might think of. For the client, it's represented by a small home window, or a different web site, where they need to pass via the check out.Purchase status is returned to the payment portal, after that passed to the site. A customer gets a message with the transaction condition (accepted or refuted) through a repayment system user interface.

Now we are moving closer to payment portals in their variety. Settlement gateway assimilation Usually, there are 4 main methods to incorporate a repayment gateway.

First Data Merchant Services for Dummies

What is PCI DSS conformity and also when do you require it? In instance you just need a payment gateway remedy and also don't prepare to shop or procedure debt card information, you may avoid this area, because all the processing as well as governing worry will be accomplished by your gateway or payment company. payment hub.is a necessary aspect for processing card settlements. This safety requirement was produced in 2004 by the four biggest card associations: Visa, Master, Card, American Express, and Discover. To end up being PCI compliant, you will have to finish 5 steps:. There are four degrees of conformity that are established by the variety of risk-free purchases your organization has actually ended up.

The smart Trick of Payeezy Gateway That Nobody is Discussing

Offered this details, we're mosting likely to check out the existing combination alternatives and clarify the benefits and drawbacks of each. We'll additionally focus on whether you must adhere to PCI DSS in each situation as we describe what integration methods match various kinds of organizations. Organized gateway A hosted repayment portal acts as a 3rd party.Primarily, that's the situation when a consumer is redirected to a payment portal internet page to type in their credit rating card number. Held payment entrance work system of an organized settlement entrance are that all repayment processing is taken by the solution company.

Utilizing a hosted entrance requires no PCI compliance as well as uses quite easy combination. Clients might not trust third-party repayment systems.

The smart Trick of Merchant Services That Nobody is Discussing

Primarily, it's a piece of HTML code that executes a Pay, Chum button on your checkout web page.Direct Post approach Direct Article is a combination method that allows a consumer to shop without leaving your internet site, as you do not have to get PCI compliance. Direct Article assumes that the purchase's information will be published to the repayment gateway after a consumer clicks a "purchase" switch. The data immediately reaches the portal as well as cpu without being kept on your very own server.

This is basically a prebuilt portal that can be personalized and branded as your very own. Here are some popular white label remedies developed for useful content merchants: An incorporated entrance can be a committed resource of revenue, as vendors that get all the required conformity come to be repayment company themselves. This implies your service can process payments for other sellers for a cost.

How Virtual Terminal can Save You Time, Stress, and Money.

are that you have full control over the deals at your web site. You can customize your settlement system as you want, as well as tailor it to your service requirements. In useful site situation of a white-label service, the settlement gateway is your well-known modern technology. usually are all regarding keeping the infrastructure of your repayment system and also the related expenses.Here are some points to consider prior to selecting a provider. Research study the rates Settlement handling is complex, as it includes several economic institutions or organizations. Like any type of solution, a settlement portal needs a fee for using third-party tools to process as well as license the deal. Every event that participates in repayment verification/authorization or handling costs fees.

Every settlement option service provider has its very own terms of use and charges. Typically, you will certainly have the adhering to charge types: gateway configuration fee, month-to-month entrance fee, vendor account arrangement, and also a charge for each purchase processed.

The smart Trick of Virtual Terminal That Nobody is Talking About

This is generally a prebuilt portal that can be customized and branded as your own. Below are some well-known white tag options designed for sellers: An integrated portal can be a specialized source of earnings, as vendors that acquire all the necessary compliance become payment company themselves. This means your company can refine settlements for other sellers for a cost.are that you have full control over the transactions at your website. You can personalize your payment system as you want, and tailor it to your organization needs. In instance of a white-label option, the settlement entrance is your branded modern technology. normally are everything about maintaining the framework of your repayment system and the related costs.

The 30-Second Trick For Fintwist Solutions

Every repayment option supplier has its very own terms of usage and also charges. Generally, you will certainly have the adhering to cost types: entrance configuration charge, month-to-month entrance cost, vendor account setup, as well as a fee for each and every purchase processed. Read all the rates paperwork to prevent concealed fees or extra expenses. Inspect transaction limits for a given provider While fees as well as setup costs are unavoidable, there is something that may establish websites whether you can work with a specific company.Report this wiki page